Rental Property Sale Rollover . — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll. — you can do a real estate rollover from a 1990s residential investment property into a newly built house (higher asset. “if i sell a rental property (or holiday home) but use the money to buy another is it true that i won’t have to pay tax?” the answer. — from assessing the property’s value and preparing it for sale to understanding tax implications, this redfin.

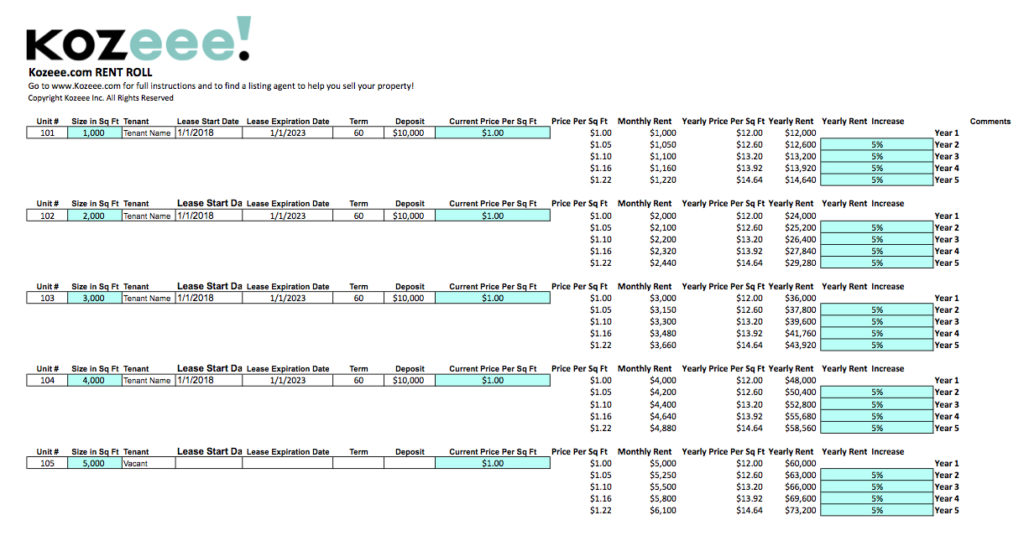

from www.kozeee.com

“if i sell a rental property (or holiday home) but use the money to buy another is it true that i won’t have to pay tax?” the answer. — you can do a real estate rollover from a 1990s residential investment property into a newly built house (higher asset. — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll. — from assessing the property’s value and preparing it for sale to understanding tax implications, this redfin.

How to make a rent roll Free Template Kozeee!

Rental Property Sale Rollover — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll. “if i sell a rental property (or holiday home) but use the money to buy another is it true that i won’t have to pay tax?” the answer. — from assessing the property’s value and preparing it for sale to understanding tax implications, this redfin. — you can do a real estate rollover from a 1990s residential investment property into a newly built house (higher asset. — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll.

From www.formsbirds.com

Rent Roll Form 5 Free Templates in PDF, Word, Excel Download Rental Property Sale Rollover — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll. — from assessing the property’s value and preparing it for sale to understanding tax implications, this redfin. “if i sell a rental property (or holiday home) but use the money to buy another is it true that i won’t. Rental Property Sale Rollover.

From www.uslegalforms.com

Apartment Rent Roll Form Fill and Sign Printable Template Online US Rental Property Sale Rollover — you can do a real estate rollover from a 1990s residential investment property into a newly built house (higher asset. — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll. — from assessing the property’s value and preparing it for sale to understanding tax implications, this redfin. . Rental Property Sale Rollover.

From www.realtor.com

For Sale 12318 McCord Rd, Elkins, AR 72727 Rental Property Sale Rollover — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll. “if i sell a rental property (or holiday home) but use the money to buy another is it true that i won’t have to pay tax?” the answer. — from assessing the property’s value and preparing it for sale. Rental Property Sale Rollover.

From old.sermitsiaq.ag

48 Hour Notice To Enter Template Rental Property Sale Rollover — you can do a real estate rollover from a 1990s residential investment property into a newly built house (higher asset. “if i sell a rental property (or holiday home) but use the money to buy another is it true that i won’t have to pay tax?” the answer. — a 1031 exchange occurs when real estate. Rental Property Sale Rollover.

From wiki.barscloud.com

Rollovers KB Rental Property Sale Rollover — from assessing the property’s value and preparing it for sale to understanding tax implications, this redfin. — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll. — you can do a real estate rollover from a 1990s residential investment property into a newly built house (higher asset. . Rental Property Sale Rollover.

From www.stags.co.uk

Stags property for sale in Botus Fleming, Saltash Rental Property Sale Rollover — you can do a real estate rollover from a 1990s residential investment property into a newly built house (higher asset. — from assessing the property’s value and preparing it for sale to understanding tax implications, this redfin. — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll. . Rental Property Sale Rollover.

From www.opensourcetext.org

11+ Rent Roll Template Editable Free Download [Word, PDF] Rental Property Sale Rollover “if i sell a rental property (or holiday home) but use the money to buy another is it true that i won’t have to pay tax?” the answer. — you can do a real estate rollover from a 1990s residential investment property into a newly built house (higher asset. — a 1031 exchange occurs when real estate. Rental Property Sale Rollover.

From turbo-tax.org

How To Prevent A Tax Hit When Selling A Rental Property Turbo Tax Rental Property Sale Rollover — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll. “if i sell a rental property (or holiday home) but use the money to buy another is it true that i won’t have to pay tax?” the answer. — you can do a real estate rollover from a 1990s. Rental Property Sale Rollover.

From www.foundry-eqpt.com

Used KLOSTER 10,000 LB IN LINE MOLD ROLLOVER for Sale in Stow, Ohio Rental Property Sale Rollover — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll. “if i sell a rental property (or holiday home) but use the money to buy another is it true that i won’t have to pay tax?” the answer. — you can do a real estate rollover from a 1990s. Rental Property Sale Rollover.

From www.kozeee.com

How to make a rent roll Free Template Kozeee! Rental Property Sale Rollover — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll. “if i sell a rental property (or holiday home) but use the money to buy another is it true that i won’t have to pay tax?” the answer. — you can do a real estate rollover from a 1990s. Rental Property Sale Rollover.

From www.trulia.com

114 Rolling Hill Drive, Horseshoe Bay, TX 78657 MLS 170492 Trulia Rental Property Sale Rollover — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll. “if i sell a rental property (or holiday home) but use the money to buy another is it true that i won’t have to pay tax?” the answer. — you can do a real estate rollover from a 1990s. Rental Property Sale Rollover.

From giotlgzig.blob.core.windows.net

Park Homes For Sale Bath at Edythe Cole blog Rental Property Sale Rollover — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll. — from assessing the property’s value and preparing it for sale to understanding tax implications, this redfin. — you can do a real estate rollover from a 1990s residential investment property into a newly built house (higher asset. . Rental Property Sale Rollover.

From app.fespa.com

Rollover Flatbed Applicators Rental Property Sale Rollover — you can do a real estate rollover from a 1990s residential investment property into a newly built house (higher asset. “if i sell a rental property (or holiday home) but use the money to buy another is it true that i won’t have to pay tax?” the answer. — a 1031 exchange occurs when real estate. Rental Property Sale Rollover.

From theresabradleybanta.com

Multifamily Rent Roll Analysis Rental Property Sale Rollover — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll. “if i sell a rental property (or holiday home) but use the money to buy another is it true that i won’t have to pay tax?” the answer. — you can do a real estate rollover from a 1990s. Rental Property Sale Rollover.

From new2.megadox.com

Ontario Section 85 Rollover Corporate Approval and Implementation Forms Rental Property Sale Rollover — you can do a real estate rollover from a 1990s residential investment property into a newly built house (higher asset. — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll. — from assessing the property’s value and preparing it for sale to understanding tax implications, this redfin. . Rental Property Sale Rollover.

From www.trulia.com

109 York Town Ln, Gainesboro, TN 38562 SingleFamily Home for Sale Rental Property Sale Rollover — from assessing the property’s value and preparing it for sale to understanding tax implications, this redfin. “if i sell a rental property (or holiday home) but use the money to buy another is it true that i won’t have to pay tax?” the answer. — you can do a real estate rollover from a 1990s residential. Rental Property Sale Rollover.

From new2.megadox.com

Ontario Section 85 Rollover Corporate Approval and Implementation Forms Rental Property Sale Rollover — a 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll. — you can do a real estate rollover from a 1990s residential investment property into a newly built house (higher asset. “if i sell a rental property (or holiday home) but use the money to buy another is it. Rental Property Sale Rollover.

From propertymetrics.com

Rent Roll Template PropertyMetrics Rental Property Sale Rollover “if i sell a rental property (or holiday home) but use the money to buy another is it true that i won’t have to pay tax?” the answer. — from assessing the property’s value and preparing it for sale to understanding tax implications, this redfin. — you can do a real estate rollover from a 1990s residential. Rental Property Sale Rollover.